Finance

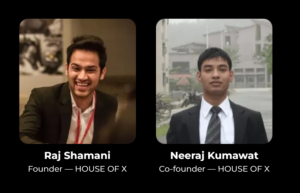

Brand in a Blink: Raj Shamani’s House of X Promises Rapid Creation for Creators!

Founded in September 2022 by Raj Shamani and Neeraj Kumawat, House of X aims to stand at the forefront of transforming how creators conceive and launch brands, ushering in a new era of entrepreneurial possibilities within the thriving Creator Commerce Industry.

Positioning itself as a comprehensive enabler for online businesses, House of X handles every aspect of the operational process, from identifying the right product idea for the creator to managing sourcing, warehousing, shipping, customer service, and facilitating scalable growth for creators.

Shamani, a Forbes India 30 under 30 alumni, was quoted saying, “We aim to build a global commerce infrastructure that enables the creation of digital-first creator-led D2C brands.”

Currently tied with popstar King and chef Sanjyot Keer, House of X is currently in talks with 20 more creators they plan to help grow. They teamed up with King in April 2023 and launched their first brand; Blanko. They claimed that the launch day of the perfume brand was hugely succesful with sales over Rs 20 lakh. In the next couple of months, they sold more than 20,000 units and hit Rs 1 crore in sales revenue on a monthly basis. YFL or Your Food Lab with celebrity chef Sanjyot Keer was the second creator brand launch by House of X in 2023. This kitchenware brand aims to provide cutting-edge products to cooking enthusiasts in the country. The success of YFL Home post-launch further underscores House of X’s ability to capture market demand and deliver innovative solutions.

In an interview with Moneycontrol, Shamani explained how the company comes together to help creators, “Creators understand audience & we understand business therefore we provide end to end infrastructure for them.” They take care of the “unsexy business side” so creators can focus on doing what they are good at: “storytelling”.

House of X has a notable list of investors and early backers as well: Nikhil Kamath (Zeroda), Varun Alagh (Mamaearth), Ghazal Alagh (Mamaearth), Asish Mohapatra (OfBusiness), Shashank Kumar (Razorpay), Sahil Barua (Delhivery), Ankush Sachdeva (ShareChat), Miten Sampat (Cred) and more.

Finance

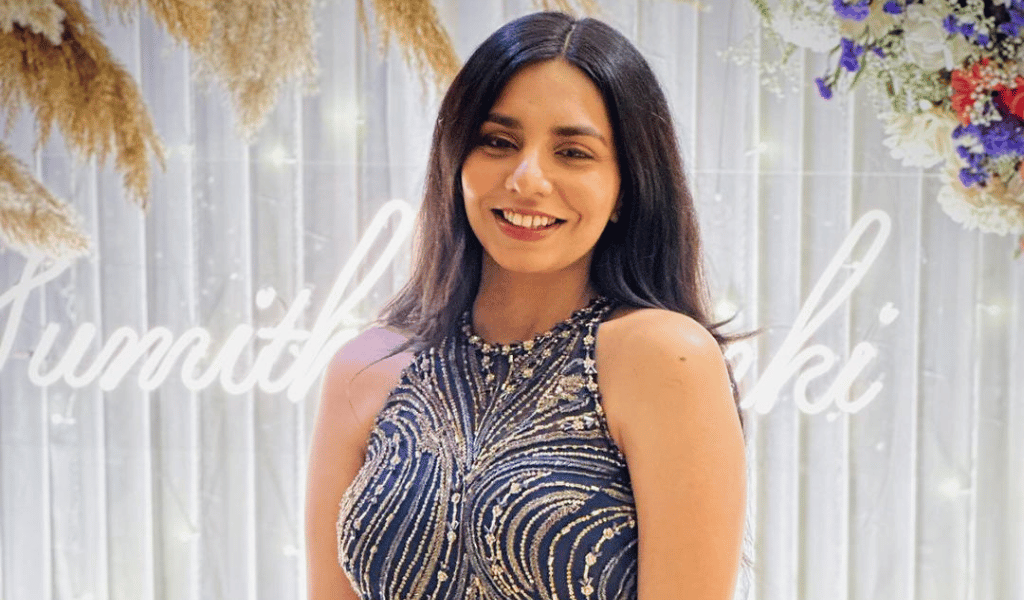

Explore Financial Literacy with Himani Chaudhary

Himani Chaudhary is a financial content creator whose aim is to make financial literacy simple for the layman. She is an AMFI (Association of Mutual Funds in India) registered Mutual Funds Distributor and a certified research analyst from NISM (National Institute of Securities Market). This Delhi based finance educator has helped more than 10K people start their investment journey in Mutual Funds.

Social Media Presence

Himani Chaudhary currently has 1 million followers on Instagram, which is commendable as she has earned it over the years on social media.

She has 42k subscribers on YouTube. Here, she makes detailed videos based on trending financial updates, such as the RBI’s new rules for debit and credit cards, corporate bonds, which mutual funds to invest in, free finance courses for beginners, the new rules of the National Pension Scheme, and much more.

Education & Work Experience

With a solid academic foundation in Data Analytics from IIT Delhi, Himani Chaudhary brings a unique perspective to her work. She also has 4 years of experience as a Risk Manager at Deloitte.

As the founder of Financial Vines, Himani Chaudhary provides comprehensive financial services and updates on various topics, including the Trending Market, Finance, investments, credit cards, new government rules, stock market, mutual funds, taxes, and financial news.

On her website, financialvines.com, Himani Chaudhary offers a wealth of free resources, including books, Excel sheets, and strategies, for stock market and personal finance needs.

Here is a 1-minute summary by Himani of the 2024 budget which was announced on 23rd July by the Finance Minister of India, Nirmala Sitharaman:

Follow Himani Choudhary for some great finance tips!

Finance

CA Karan Sheth Simplifies Tax Education

CA Karan Sheth is a professional teacher and content creator. He creates content related to funny CA memes and finance related topics like stocks, taxation, finance, GST, and much more. Karan Sheth also teaches taxation to CA Intermediate and CA Final students. He aims to teach students so that they clear CA exams and gain knowledge about entrepreneurship through his stories and social media posts.

Journey from Half CA to CA

In November 2015, after four attempts at the FINAL CA exam with just one group remaining, Karan took a step back from his dream. The pressure of getting back to the same situation became overwhelming for him. But this setback led him to teach CA aspirants. His dedication paid off and his students achieved top ranks. Despite his role as a mentor, a void persisted, reminding him of his unsuccessfulness in his CA journey. In May 2019, he encouraged himself for another attempt to clear his Final CA exam. He was grinding himself with the preparations with sleepless nights and day-in day-out practice. But he failed with just 2 marks and decided to give it another attempt before he finally achieved it. The day he passed, he proudly shared his achievement with his students, “Aaj aapke sir HALF CA se CA ban gaye hain.”

YouTube Channel – Tax Ka Teacher

His YouTube channel, Tax Ka Teacher, is a platform for teaching CA/CS/CMA students. As TaxKaTeacher, his mission is to ensure that the next attempt is the last attempt for his students. With 40.6K subscribers, he constantly shares insights on topics related to taxation. From taking lectures on YouTube explaining important MCQs for CA intermediate exams, case studies, key questions and much more related to taxation for a CA. On the same website, you can see blogs for a CA or a taxation enthusiast. The subjects of the blogs are the power of mock tests, tips for clearing CA Intermediate in the first attempt, requirements to become a CA in India and Development in the Financial Management.

Follow CA Karan Sheth aka Tax Ka Teacher for insights on taxation. You will benefit by following him or hiring him as your tax teacher.

Finance

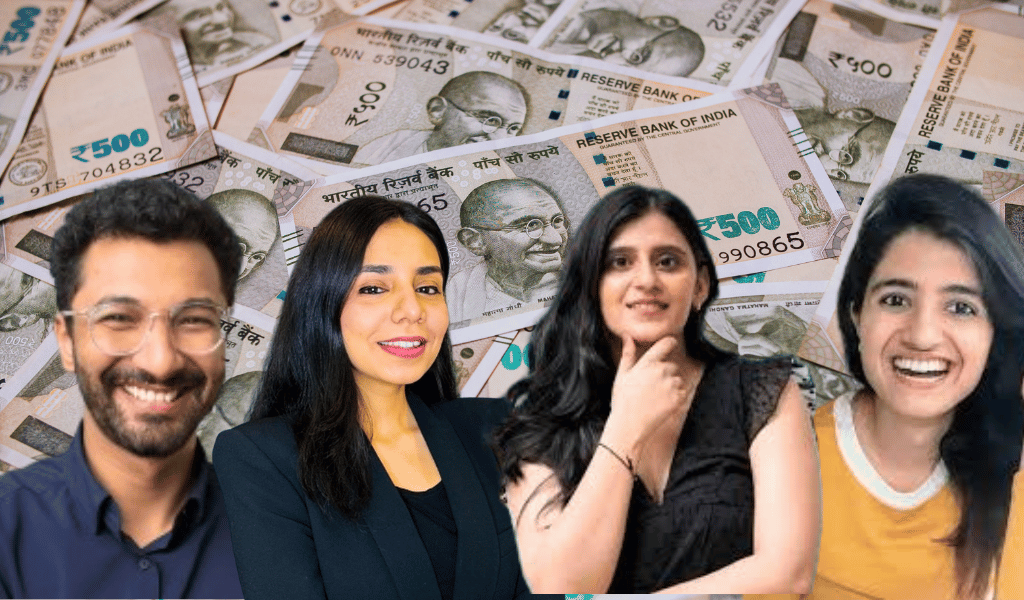

Financial Influencers Share Updates on Union Budget 2024

As Finance Minister Nirmala Sitharaman presents the Union Budget 2024 today. Moreover, everyone is eager to understand its implications for the economy, both broadly and individually. Financial influencers are already sharing their insights and perspectives on the new budget.

Let’s take a look at some key takeaways from Fin-fluencers on Union Budget 2024:

Udayan Adhye’s Pointers

Udayan Adhye highlighted two significant changes to personal income tax introduced in the new budget. He believes these changes are positive. The first change is that individuals with an annual income below INR 7.75 lakhs will not have to pay any tax. The second change involves adjustments to the new tax slabs for different income groups. Previously, a 15% tax was levied on salaries above INR 9 lakhs. Furthermore, but now this 15% rate applies only to income above INR 10 lakhs. However, these changes are applicable only to those under the new tax regime and not the old regime.

Neha Nagar’s Take

Neha Nagar shared a comic video implying that the budget does not offer substantial tax relief for salaried individuals, instead favoring larger business entities. Her lighthearted approach underscores a critical view that the budget might benefit big businesses more than the common salaried employee.

CA Bhagyashree Thakkar’s Insights

CA Bhagyashree Thakkar provided her analysis of the budget. She mentioned that salaried individuals should be pleased with the increase in the standard deduction from INR 50,000 to INR 75,000. However, she also noted that those investing in the stock market or mutual funds for long-term capital gains will now face a 12.5% tax, up from the previous 10%. On the positive side, the exemption on these long-term capital gains. However, has been increased from INR 1 lakh to INR 1.25 lakhs. Additionally, short-term profits from the stock market will now be taxed at 20%, up from the previous 15%.

Himani Chaudhary’s Summary

Himani Chaudhary shared a concise summary of the Union Budget 2024 for the general public. One notable announcement is that the central government will offer students internships in the top 500 companies in India, with a stipend of INR 5,000 per month. They will also get a one-time additional payout of INR 6000. Additionally, she pointed out that gold, silver, copper, steel, mobile phones, and chargers will become cheaper following this budget.

Overall, the Union Budget 2024 has brought a mix of changes affecting various sectors and income groups differently. As more details unfold, individuals and businesses will continue to assess the impact on their financial planning and strategies.

-

Entertainment2 weeks ago

Entertainment2 weeks agoInfluencers Running Successful Business Ventures

-

Tech2 weeks ago

Tech2 weeks agoYouTube Shorts is Launching New Tools Soon!

-

Lifestyle2 weeks ago

Lifestyle2 weeks ago5 Religious Content Creators To Follow On Instagram

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoYouTube FanFest India is Back with “Bohot Kadak Lineup”

-

Asian4 days ago

Asian4 days agoSatisfy Your K-Drama Cravings in July 2024 with These New Releases

-

Lifestyle3 weeks ago

Lifestyle3 weeks agoFrom Grassroots to Global: Gauri Maulekhi’s Journey Empowers Change

-

Lifestyle1 week ago

Lifestyle1 week agoInfluencer Aanvi Kamdar Dies While Shooting A Reel On Trip

-

Fashion3 weeks ago

Fashion3 weeks agoJeet Tailor makes ‘Old Money Aesthetic’ seem child’s play