Brand Studio

Why Mango Millionaire is the Finance Book Every Indian Should Read!

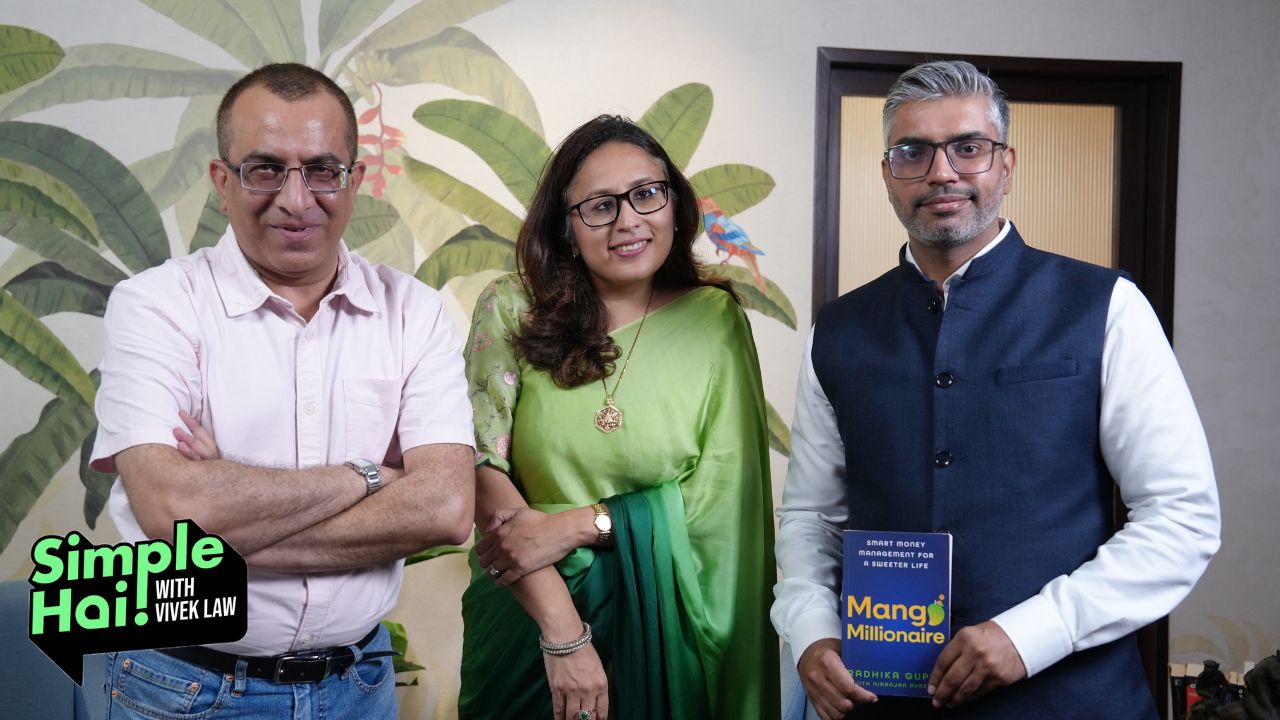

In a special Simple Hai! episode, Radhika Gupta and Niranjan Avasthi share how their book 'Mango Millionaire' helps common Indians take smarter steps towards financial freedom.

Financial literacy remains low in India, and many people are unsure of where to start their financial journey. In a recent episode of the Simple Hai! show, host Vivek Law spoke to two experts who want to change that. Radhika Gupta, MD & CEO of Edelweiss Mutual Fund, and Niranjan Avasthi, SVP at Edelweiss MF, discussed their new book, “Mango Millionaire.” It’s a personal finance guide that makes investing, saving, and managing money simple and relatable for Indians.

The Idea Behind Mango Millionaire

The title of the book comes from a famous line in the film Love Aaj Kal, where Saif Ali Khan says, “We are mango people.” That thought stuck with Avasthi. Most Indians don’t dream of becoming billionaires. They want enough to live well, support their families, and retire peacefully. That’s the kind of millionaire this book is for.

The inspiration to write the book came from Gupta’s earlier work, Limitless, and her ability to break down complex ideas into simpler, more accessible ones. The goal? To create a book that feels like a conversation with a friend, filled with examples from films and everyday life.

Start with Saving, Not Investing

One key lesson from the book: don’t jump into investing without first getting the basics right. Gupta explained that before talking about equity or bonds, readers need to understand how to save and avoid bad debt.

Avasthi shared a personal story about being extra cautious with spending in his 20s, and how that mindset helped him stay disciplined. Gupta agreed but reminded viewers that enjoying life is also important. The middle path, saving and spending wisely, is what they recommend.

10-30-50: A Rule That Works

The book offers a practical framework for saving:

- In your 20s: Save 10% of income

- In your 30s: Increase it to 30%

- In your 40s and beyond: Aim for 50%

Avasthi said this model is based on real-life situations and avoids putting pressure on young earners. It’s about building habits that grow with you.

Watch all Simple Hai! episodes HERE!

Good Debt vs Bad Debt

Another chapter deals with debt, which many Indians struggle with. Gupta explains that borrowing for needs like education or a home is good debt. But borrowing for luxury items or using credit cards without control is bad debt. Avasthi adds that EMIs should not exceed 30% of your income, and your total loans shouldn’t be more than three times your yearly income. Keeping 6 months of EMI as backup is also key.

Don’t Just Invest: Plan Withdrawals Too

Most people know about SIPs (Systematic Investment Plans), but not many understand SWPs (Systematic Withdrawal Plans). Gupta and Avasthi stress that how you withdraw money matters as much as how you invest it. SWPs are especially helpful for retirees or people with irregular income, like entrepreneurs or homemakers.

Money Lessons from Films and Family

The book also touches on the emotional aspects of money. Gupta spoke about how her mother, despite being educated in economics, was hesitant to talk about money. After reading the book, she finally connected with it. That’s the power of storytelling.

Avasthi added that references to movies like Mother India and Baghban make the content more relatable. These stories show how many older Indians sacrifice their own financial security for their kids.

What’s on Your Thali? Asset Allocation Made Easy

The authors replace the term “asset allocation” with the more Indian concept of a “thali”. Just like every dish has a place on a thali, every asset, gold, equity, bonds, or cash, has a role in your portfolio. Gupta warns against chasing only gold or stocks based on recent performance.

Also Read: Rethinking Retirement and Financial Well-being from Ajit Menon Only on The Simple Hai!

Retirement = Freedom, Not the End

The book changes how we see retirement. Avasthi says retirement doesn’t mean stopping work, it means working on your own terms. Gupta adds that the real goal is financial independence, not just building assets. Having income after retirement is more useful than owning property you can’t easily sell.

Finance Should Be Fun and Friendly

Both authors believe finance doesn’t have to be boring or filled with jargon. Gupta said, “If people are going to read a finance book, it might as well be fun.” Avasthi added that movie and food references make the book more inclusive, especially for women and those not into sports.

Why This Book Matters? Because It Offers Simple Finance for Everyday Indians

Mango Millionaire stands out because it speaks to the real financial lives of Indians. It doesn’t promise overnight riches. Instead, it gives you the tools to build a secure, happy future. Avasthi summed it up best: “Most people know they should invest, but don’t take the first step. Our book helps you start.”

If you’re unsure about money or just want to understand it better, this book and the Simple Hai! episode with Gupta and Avasthi are great places to begin.